- LinkWave

- Posts

- Here’s How Generative AI is Transforming Commercial Real Estate

Here’s How Generative AI is Transforming Commercial Real Estate

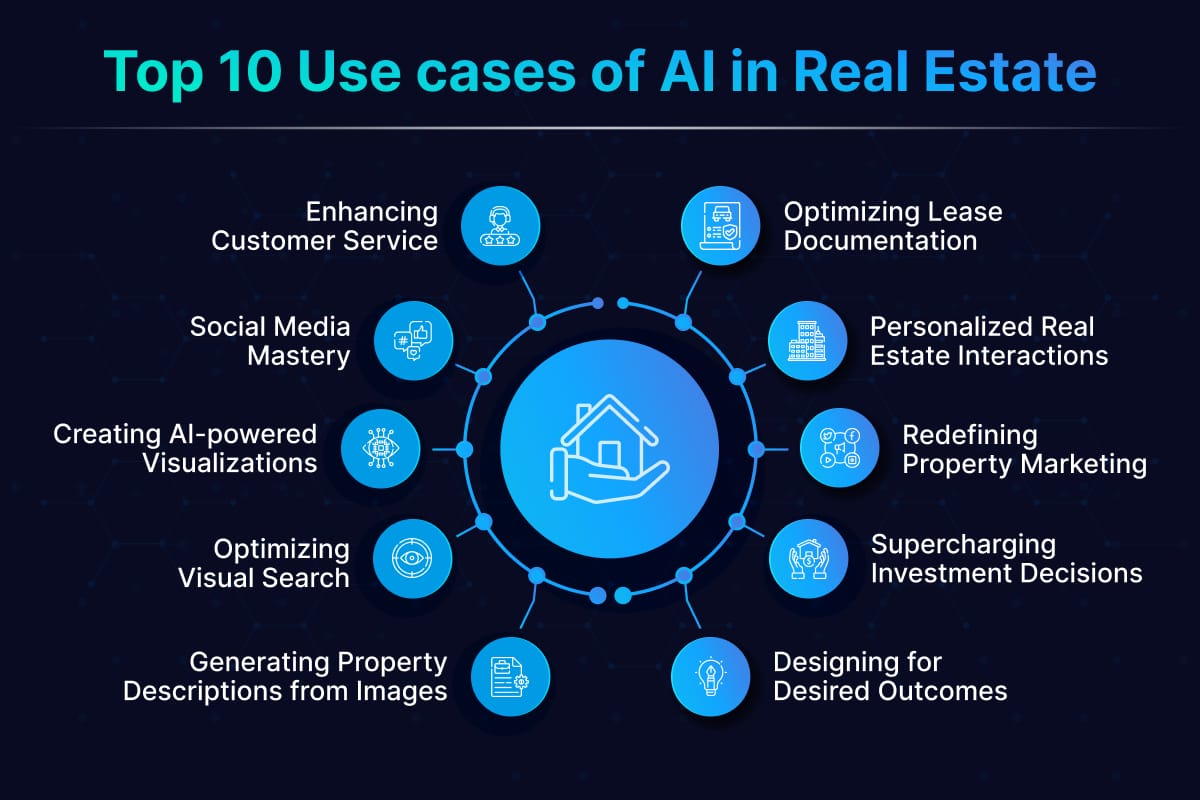

Explore how generative AI is reshaping property management, investment strategies, and risk management in commercial real estate.

Generative AI is revolutionizing the commercial real estate (CRE) industry by streamlining key processes, improving investment strategies, and enhancing property management. The transformative capabilities of AI are enabling real-time data analysis, predictive insights, and more informed decision-making. As the industry embraces these cutting-edge technologies, AI adoption is becoming a crucial part of staying competitive in an ever-evolving market.

Generative AI in Property Management

Property management in commercial real estate involves complex tasks, from tenant communication to maintenance schedules. With generative AI, property managers can now automate routine tasks, predict maintenance issues before they escalate, and optimize energy usage.

For example, AI-powered platforms can forecast maintenance needs based on usage patterns, potentially reducing operational costs and improving tenant satisfaction. Moreover, smart building technologies driven by AI are being integrated to monitor energy consumption and ensure buildings operate at maximum efficiency.

Case Study:

A commercial office building in New York adopted an AI-powered property management system, which reduced maintenance costs by 15% and improved tenant retention by 20% through better service responses.

AI-Driven Investment Strategies

Generative AI is also making waves in real estate investment strategies. By analyzing vast amounts of data from various sources, AI can predict market trends, identify high-potential properties, and recommend the best investment opportunities based on risk tolerance and portfolio objectives.

This approach allows investors to take a more data-driven, automated route, reducing human error and improving investment decision-making. AI’s ability to assess property valuation over time and forecast rental yields is particularly valuable in an increasingly volatile market.

Example:

AI systems used by investment firms are helping them analyze past sales trends, market demand, and tenant behavior to predict which properties will yield the best returns in the future.

Balancing Rewards and Risks

While the rewards of AI adoption in commercial real estate are clear—increased efficiency, improved ROI, better tenant experiences—there are also risks that need to be carefully managed.

AI adoption introduces data security concerns, especially with the sensitive financial and tenant data used by AI systems. Furthermore, the potential for AI model bias—where the algorithm's recommendations are shaped by incomplete or biased data—remains a challenge.

To balance these risks and rewards, CRE companies are developing AI adoption frameworks that prioritize ethical data usage, risk mitigation strategies, and human oversight. This ensures that AI technology can be leveraged for growth without compromising safety, fairness, or privacy.

Future Outlook: The Role of Generative AI in CRE

As the CRE sector continues to embrace generative AI, the future of real estate will be marked by even greater levels of automation, precision, and efficiency. From automated lease agreements to predictive market models, AI is set to become the backbone of every aspect of commercial real estate operations.

By 2028, AI-powered tools are expected to become standard in both property management and investment decision-making—providing businesses with a competitive edge in the evolving real estate landscape.

Embracing the AI Advantage in CRE

The commercial real estate industry is at the cusp of a massive transformation. As generative AI continues to shape investment strategies, property management, and more, its potential to reshape the industry is vast. Real estate professionals who embrace AI will be positioned to stay ahead of the curve, unlocking efficiencies and opportunities that were once unimaginable.

Reply